The Illusion of Readiness

Pods Trading the Same Meme Stock

Kobe would've hated the multi-manager pod world, just as I think he wouldn't have really liked the current NBA's era of player empowerment. Two worlds with parallel narrative arcs…

Both systems reward players for chasing the next opportunity rather than mastering their current position, prioritizing individual leverage over team excellence, and confusing motion with progress.

Let's be clear, Kobe wouldn't have hated the pod world because of the ambition. He'd respect that. Kobe literally built his entire professional player career around obsession, understanding the stakes, what it took to have the opportunity to be great, and the willingness to compete inside a corporate machine that had the potential to eat people alive. That's the kind of arena he trained for. But he would've smelled the incentive structure rot instantly. The incentives warped by speed, phonies, fake culture, self-enrichment. The culture of borrowed process and pseudo homage.

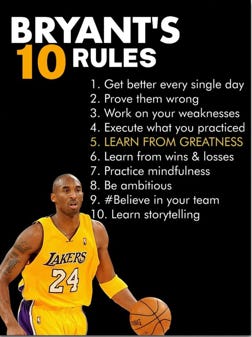

Kobe built his career around ten operating principles - rules forged through thousands of repetitions, through facing weakness instead of avoiding it, through building something sustainable instead of something flashy. Get better every single day. Prove them wrong. Work on your weaknesses. Execute what you practiced. Learn from greatness. Learn from wins and losses. Practice mindfulness. Be ambitious. Believe in your team. Learn storytelling.

I say this because I've watched these principles get systematically inverted by an industry that should know better.

I have been inside the mothership. I have been an analyst and a portfolio manager, and I have managed risk. I was a PM and ran my own book, sometimes multiple strategies. I oversaw risk for other PMs, I have been a CIO, I have built and rebuilt investment processes for short selling funds, macro funds, event-driven funds, merger arb strategies, long / short and across the capital structure funds. I have spent time with investment folks of all levels at these shops as well as operations.

The pod system has created a generation of analysts who mistake opportunity for readiness. I understand the analysts who prematurely sprint to be in control of their portfolio before they haven't earned it, but think, even believe, they have earned it. The whole ecosystem has been designed to reward short-term output, not building intermediate term and long-term foundation.

The current asset management world, more specifically inside the multi-manager pod system, doesn't make analysts anymore. Analysts are no longer trained, groomed to be good or even great anymore. The multi-manager pod system just leases them.

Which becomes obvious when you compare what real development looks like.

Kobe filmed 4:30 a.m. workouts to critique his own footwork. Not to prove something. To fix something. What you do when no one is watching - that's what matters. He trained on the left until it felt like the right. He worked the spots where he got bullied and pushed around by bigger, stronger and older players whose bodies and game had been hardened. Not because he liked it, although I think he loved the process and wanted to be identified with not only the best programming but also having the best adaptive process to be great and differentiate himself amongst his peers as well as the reporters. Kobe knew that's where the season would be won, in the spaces where he was vulnerable.

He watched film after wins. Can you believe that? Kobe watched film of himself looking for excruciating details, after his Lakers team won the game. Why? Because he didn't trust outcomes. He didn't always even trust patterns. But this was part of his process. If a move worked, he wanted to know why, and if it should've worked. He wanted to know whether he was lucky or skilled, and actually was disappointed when it was luck. He studied the lies inside the win. Because he knew the ego after success was more dangerous than the pain after failure.

He cornered Jerry West. He hounded MJ with text messages at all hours of the night. He grilled Reggie Miller about footwork all summer long playing pickup games at UCLA. This wasn't networking. This was apprenticeship. He was seeking invisible knowledge that couldn't be found in highlight reels or stat sheets. The kind of understanding that only comes from sitting with greatness and absorbing not just what they did, but how they thought about what they did.

The recruitment cycle has become a self-reinforcing delusion machine. Third party recruiter hits you up on LinkedIn, or perhaps they tracked down your mobile number from a sell-side desk or even your sales coverage. All they have to say is they have heard about you, and that you are a money maker, and they dangle that PM title in front of you. A new TMT book at XYZ pod is launching with $1 billion and line of sight to $2 billion by the end of the year as soon as they get some bodies in the seats. The PM came over from another podshop, and was successful last year, but the core of his team of analysts and traders have gardening leave, those mandatory months between jobs where you can't work but still get paid, so there are two open spots right now.

You will get a 2 year guarantee and there is an opportunity over time to get your own sleeve of capital. And you think to yourself, that you just got this seat 9 months ago. Your first stub bonus is what your contract said you would get, but you thought for sure you would get at least 25% more because of how strong your last 2 picks performed. "Maybe I am being undervalued?"

Analysts have learned to optimize for attribution over absorption—and it shows in everything they won't do. The analysts won't even update their watchlists unless they see they have fewer names in the portfolio than their peers. And it's not laziness. It's incentives. Why do the boring work when no one is looking? They won't even sit in on meetings they're not staffed on. And again, it's not because they don't care. It's because the ecosystem taught them to optimize for attribution, not absorption. Learning takes a backseat to optics. So they say "no bandwidth," and keep working on the deck or writeup for a name they already know inside-out to have it memorialized internally or even use to land their next seat.

They're not building out their process. They're not looking to issue spot and correct their weaknesses. They're not asking peers, friends or their PM to help identify their blind spots of where they can improve. That would tip people off that they are not infallible, and even human. They're building a résumé. They are adding bullets of self-identified accomplishments that help them stand out, when the recruiter calls or the business development person from a competitor reaches out to feel you out, and see if you are available to be poached.

Time that could build real skill gets redirected toward ego inflation instead…but here's the thing. That time that could have been spent to try and get better, they will never know if it would have worked because they are already hopping to the next seat. Their flaws remain invisible to them until one day the cycle breaks.

When analysts can't make hard decisions, house rules become their safety net, and their story. If they don't know how to cut a position after re-underwriting or an issue comes to fruition, they defer to their PM who has a risk parameter likely in place. You know that annoying risk parameter that makes you reduce after a stock goes against you 20%, even though you now believe the risk you should have seen coming is finally priced in?

I know a pod, who during earnings season basically cut oversized positions in half, and just said they would buy them back lower or higher as they were playing for the next year or even two years, versus the quarter and felt like their positioning data was more hit or miss. Understanding what you don't know.

The pod leads, and then the analyst takes the credit when the position works but leaves out the part about risk management around those positions around earnings events to their own benefit…the ones where the stock ripped after the print, but the position was cut, they wanted to super-size, and the positions that dipped, it was their advice to the PM to take some chips off the table and revisit. Either way, they tell a story that they think they actually believe…and the ecosystem does too.

The risk management that analysts claim as strategic insight is actually just following house rules they didn't write. But here's what they conveniently forget: these risk parameters are negotiated between the house and the PM before anyone even starts. The rules aren't mysterious - you might get a slightly wider drawdown structure, or different concentration limits based on average daily trading volume and how long it takes to exit positions. Maybe you get cut one-third after a 3% loss, another third after the next 3%, and you're toast at the final 3%. Or perhaps it's 5% and you're cut 50%, then the next 5% and you're done - though the house never actually lets you get to that second full threshold. There are layers of rules around position sizing, liquidity requirements, all rolling up into the main constraint: how your book gets cut during drawdowns.

The PMs know this. That's exactly why some cut systematically into earnings prints - they're navigating house rules, not making investment judgments. But once you hit that second drawdown threshold, you're not really focused on the fundamentals anymore. You're thinking about external options. The analyst knows all this, understands these were house-mandated cuts, but when it comes time to tell the story to the next recruiter…suddenly it becomes their strategic advice to trim risk. They believe this revisionist history…and the ecosystem believes it too.

Analyst pod theater. But it's not entirely the analysts' fault. Let's be real. The ecosystem encourages all of this. Because process doesn't scale across seats. P&L does. So you learn to perform conviction for recruiters, business development, your peers, and even your own PM. You perform it because you have convinced yourself that it signals that you have an investment process that you can take with you. The tools for real improvement are right there. You're just choosing not to use them because they don't help you get the next seat.

The system's psychological pressure reveals itself when slights inevitably occur. You got sized down in a couple of your names? Your PM "doesn't get it"? You didn't get the elevated seat with more responsibility? So you look around. You start taking intro calls. You tweak your track record for the next call with the pod business development person.

You tell yourself you're "optimizing for fit." You're not. You're escaping discomfort before it reflects something you don't want to see.

Anonymous Twitter accounts posting compliance violations without realizing it: "I know it's the bottom because my PM just cut my names 50%. My names were up 40% last year." Missing that it's risk management, not lack of faith, while broadcasting internal portfolio decisions to the world.

Even worse, analysts complaining about their PMs to other analysts. Going behind their mentor's back to gossip with peers. It breaks down any chance of real learning or trust building.

And here's what these Twitter analysts don't understand: Twitter is not a safe place. It's not where you should be asking for advice about your career hardships. Most people don't have your best interests at heart. People like car crashes more than success stories. Yes, maybe there are a few people who give honest advice and are willing to help you "play it out," but they're probably brainwashed too into believing their own bullshit. Whether you believe this or not, the pod shops are watching. They don't always catch people. They don't even always say anything about knowing you tweet from your phone or home computer or your burner phone. But you should assume at some point they will find out. The pods are just trying to protect their own houses versus trying to play gotcha with someone on Twitter.

The surveillance infrastructure that monitors every analyst tweet makes their Twitter complaints doubly foolish. When you think about how sophisticated the trading systems are, risk systems, quant overlays, HR software, connective pipes to brokers and regulators - Bloomberg chats, Twitter DMs, emails, it's all being monitored. Using outside chats isn't allowed, but unless you're in serious violation they never say anything. Although if your tech is glitchy from time to time, that's more likely a tell that something's being monitored than actual tech problems. I remember back in my family office days (which I wrote about in "The Education That Paid Me"), we started a company in a boardroom with $5 million, two inventors, and a CEO. We gave them all the tech equipment they needed and knew exactly what they were doing - emails, work progress, everything. This was over twenty years ago. If we had that capability then with basic infrastructure, imagine what these sophisticated pod shops have now.

Despite all these pressures to keep moving, Kobe stayed. I don't think he stayed entirely because of loyalty to the Lakers. I think Kobe stayed out of clarity. Because he knew trust compounds, but only if you stick around long enough to survive the phase where it feels like it's working against you. He funneled ego into detail. He didn't weaponize it. He never whined about being disrespected like other NBA greats. He funneled that emotion into repetitions.

And here's the thing - you can't entirely blame the analysts for taking the immediate gratification. When you don't know if the music will keep playing, when you don't know if the whole system might grind to a halt, grabbing the chair while it's available makes sense. The delayed gratification play - stay, learn, build real edge - is a luxury bet that assumes the game continues long enough for patience to pay off. For many, the bird in the hand feels more rational than two in the bush, especially when the bush might disappear entirely.

Success in pod life creates its own dangerous blindness. When you're up, no one questions you. That's when decay starts. Slowly. Quietly. And when that decay hits, when the wins stop coming so easily, that's when analysts start seeking external validation and constant stimulation. Chaos worship becomes the norm. You don't get stillness and control under pressure from checking Twitter and searching by cash tag and then the ticker. You don't find it by following the group chat's take on the tape. You find it by knowing your filters/exclusions, what matters, what doesn't, issue spotting, utilizing tools, and constantly thinking through what threatens your edge on a particular position. And unless you've built that deliberately, you're not running a process. You're riding vibes.

Let's be very clear. I am not against ambition, I love it. Ambition isn't bad. But ambition without structure is just anxiety with a spreadsheet. You're not wrong for wanting the seat. But there's a difference between wanting it and being ready for it. If you're still building models without owning the assumptions behind them, still asking CFOs generic questions instead of the ones that crack open their real guidance, still running expert network calls without walking away with insights your PM didn't already know, then you're not building toward readiness. You're building toward the appearance of readiness.

The analysts who finally get their own book discover that wanting control isn't the same as being ready for it. The analysts are willing to take risks when they're the analyst. They'll push for big positions, argue for concentration, take swings. But the moment they get their own book, they discover what actual accountability feels like. Suddenly every position is terrifying because there's nowhere to hide. The bold positions they pushed as analysts become paralyzing when it's their name on the risk sheet. They don't actually want the seat. They want the illusion of control. Because once you get the controls, once it's your name on the end of day risk sheet, the excuses don't save you. There are no longer any excuses. The process has to hold. And most haven't built out a process, albeit they probably have some materials with diligence check lists, and they sign off on the risk parameters provided by the house. But what do they really have? (As I wrote in "Everyone Has a Process," having materials isn't the same as having a process.) Until it breaks down and reality hits.

And here's the dirty secret about that early success: much of it isn't even yours. The TMT analyst walks out with his entire AI playbook, charts and KPIs and the whole domino effect mapped out, none of which he actually developed. The energy long-short guy takes all his maps, all his models, all his trade structures, his expert network call notes on C-suites that are spinning off assets. Even with gardening leave, you can ride someone else's intellectual property for twelve to twenty-four months. By the time that pipeline runs dry and you have to generate original alpha, you're already networked with all the headhunters anyway, and the search begins.

Trading the Same Meme Stock

The pod game has become a meme stock that everyone knows doesn't match the fundamentals, but the returns are too good to walk away from. First contract, you're happy with the pay bump, maybe a nice dinner with your wife to celebrate. Second contract around the end of year 2 or half way through year 3? That's when the real lifestyle inflation hits. Hamptons upgrade. Private school on the Upper East Side with a hefty donation to ensure admission. Third-year performance was terrible? Doesn't matter. Some other pod needs someone who "built a successful book" and will pay you more than your last guarantee.

By now you're looking at real estate listings for another apartment in the city. Sports car and sports car race club membership. Yacht at a different port so your friends don't know you have it or you don't want them to see it. Take said yacht after a private plane for a four-week vacation that you extend another week. Upgrade the Knicks tickets.

Just like players who struggle in year three after two great seasons, some other team will still overpay for potential and fit in their system. Except in pod world, you're getting a three-year guarantee before anyone realizes your third year was a disaster. Nearly five to six years of guaranteed money by your mid-thirties, all funded by performance that happened with someone else's intellectual property.

"I built a successful TMT book at XYZ, but the platform wasn't the right fit for my investment style." Translation: I ran out of my old shop's ideas and couldn't generate new ones. But the headhunters don't care because they get paid on placement, not performance. The new pod doesn't care because they need bodies and this person has a "track record." The cycle continues.

Storytelling matters. Not because of optics. Because of clarity. If you can't explain your edge, you don't have one. Honestly, I think the entire debate over what constitutes edge is silly, but it doesn't mean it's not a conversation that should be had… But let's be really clear…if your track record isn't backed by real decision mechanics and repeatable process (for sourcing/origination, how you rank order your universe, define what you do and don't do and what instruments you utilize, defined risk parameters etc), then the story you're telling isn't yours, it's marketing of your prior seats and you are parroting your former PMs. But you know what? Right now, this works.

These weren't just motivational slogans. Kobe would have been great at just about anything…I really believe that.

I wish I had learned them earlier in my career. Had someone translate them from basketball speak into investment speak when I was coming up. Even with all the seats I've been in, all the strategies I've built, these principles could have helped me navigate the system better, avoid some of the same traps I'm watching others fall into now.

But pod world inverts every one of them. It rewards daily motion over daily improvement. It lets you switch teams instead of proving doubters wrong. It helps you hide your weaknesses behind specialization. It separates practice from performance through different incentives. It isolates you from greatness through attribution games. It only studies losses, not a closer examination of the wins. It destroys mindfulness through constant urgency and pressure cookers. It confuses loud with ambitious. It discourages team belief through constant optionality. It teaches you to tell stories before you've built anything worth telling.

The system isn't broken. It's working exactly as designed. It's producing what it's optimized for: short-term P&L generation through high turnover analysts who've learned to perform conviction instead of building it. The allocators get their quarterly updates. The PMs get their attribution. The analysts get their comp. Everyone gets what they're actually selecting for.

But nobody gets mastery. Nobody gets craft. Nobody gets the kind of edge that compounds across cycles instead of dissipating with the next job hop. What gets lost is the art of apprenticeship itself. The mentorship that never happens because everyone's always looking for the exit. The relationships that never form. The institutional knowledge that walks out the door every eighteen months. The kind of deep understanding that only comes from staying in one place long enough to see your mistakes play out over full cycles.

But what does delayed gratification actually build? Your PM knows when you've outgrown the seat, and will elevate you in other ways - probably give you a slice of the economics, a better title, maybe even a succession plan one day. Those outcomes aren't guaranteed for everyone, but here's what's more likely: after tracking you for two years, building on the four years before that, your PM says it's time to give you your own book. Your names go into both books, you get a payout structure with your own risk rules. Maybe you get involved in trading, trade structuring. Over time you build relationships with business development for hiring analysts and traders. You work with operations. You learn risk and risk reports, which leads to reporting improvements that help your PM over time. And guess what - this leads to more capital too.

You understand how your process actually performs across different market cycles. You build relationships that compound over years instead of transactional networking. You develop genuine pattern recognition instead of riding borrowed playbooks. You know which of your ideas were luck versus skill because you've seen enough iterations to tell the difference.

Maybe I'll write about the case for delayed gratification in a follow-up post. The point is, there's a real alternative to the pod game, but it requires something most analysts have trained themselves out of: the ability to stay uncomfortable long enough to find out what you're actually made of.

This brings us back to Kobe. "Rest at the end, not in the middle," he said. "Everything negative, pressure, challenges, is all an opportunity for me to rise." He understood that the discomfort wasn't the enemy - it was the work itself. The spaces where you feel vulnerable, where the process feels like it's working against you, that's exactly where real development happens.

The pod world has convinced an entire generation of analysts that discomfort signals it's time to leave. But maybe the real question isn't whether you're ready for the seat. Maybe it's whether you're willing to stay in one place long enough to find out what you're actually made of. Whether you can resist the feedback loop long enough to build something that belongs to you, not your track record.

The meme stock eventually crashes. The music eventually stops. The lifestyle inflation becomes a trap that requires the next guarantee, and the one after that. But skill compounds. Trust compounds. Real edge compounds.

And rent always comes due.

If this piece meant something to you, share it with someone who could benefit.

You can find me on twitter at @MrMojoRisinX.